Press release

FinBox raises $40M Series B to power faster, fairer, and more inclusive credit

DPI

Launch loan products with

ULI & ONDC

Automate, optimise, and govern the business logic powering your digital lending system in any environment.

DPI

Launch loan products with

ULI & ONDC

Automate, optimise, and govern the business logic powering your digital lending system in any environment.

Trusted by

Go live in a week instead of 7 months

Increase in borrowers through open platforms

Better underwriting decisions with ULI

Build for scale

Getting onboard ONDC is easy, scaling is tough. With ULI, accessing data is easy, harnessing it well is difficult. We help solve both these problems through our platform that combines product build, distribution and risk intelligence in one nifty package.

FinBox DPI stack

Partnership channels

End-to-End lending solutions

Lender APIs

FLDG Partneships

Core Banking

Digital lending

Marketplace

LMS

LOS

FinBox data products

BRE

Third-party integrations

Diverse data sources

KYC module

Lender KYC suite

Buyer apps

CRM

FinBox DPI stack

Partnership channels

End-to-end lending solutions

Lender APIs

FLDG Partneships

Core Banking

Digital lending

Marketplace

LMS

LOS

FinBox data products

BRE

Third-party integrations

Diverse data sources

KYC module

Lender KYC suite

Buyer apps

CRM

Easy integration. Quick go-live.

Easy integration. Quick go-live.

Our integrated rails allow any lender to get onboard ONDC to start disbursing there while also harnessing ULI framework to get access to real-time verified data across 50+ sources. Building a solid lending business has never been easier.

Our integrated rails allow any lender to get onboard ONDC to start disbursing there while also harnessing ULI framework to get access to real-time verified data across 50+ sources. Building a solid lending business has never been easier.

ULI

ONDC

Workflow of Unified Lending Interface

ULI

Financial & Non-Financial Data

Government

Credit Bureau

Authentication

Account Aggregator

Borrowers

User

Shop Owners

Farmers

Lenders

NBFC

Bank

Fintech

ULI

ONDC

Workflow of Unified Lending Interface

User

Shop Owners

Farmers

Borrowers

ULI

NBFC

Bank

Fintech

Lenders

Government

Credit Bureau

Authentication

Account Aggregator

Financial and Non-Financial Data

ULI

ONDC

Workflow of Unified Lending Interface

User

Shop Owners

Farmers

Borrowers

ULI

NBFC

Bank

Fintech

Lenders

Government

Credit Bureau

Authentication

Account Aggregator

Financial and Non-Financial Data

Unify lending.

With our interface.

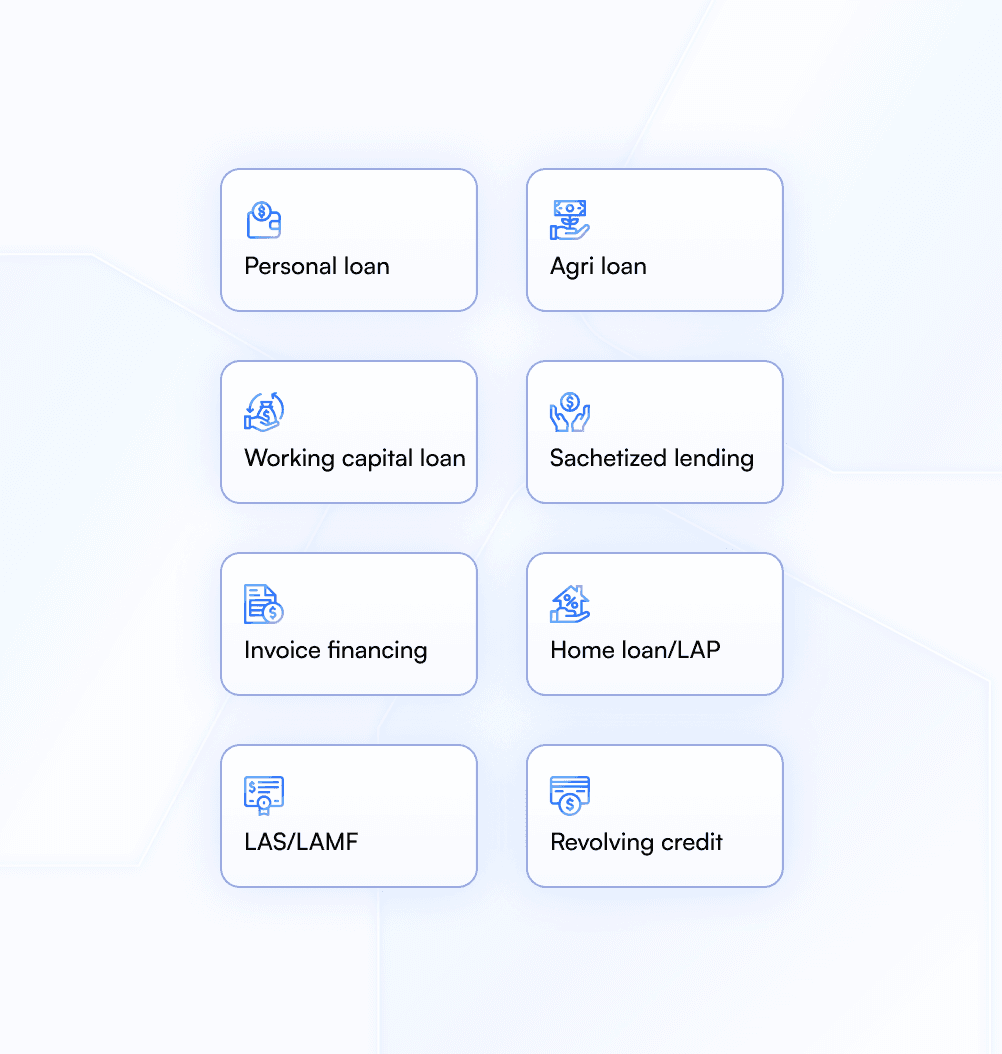

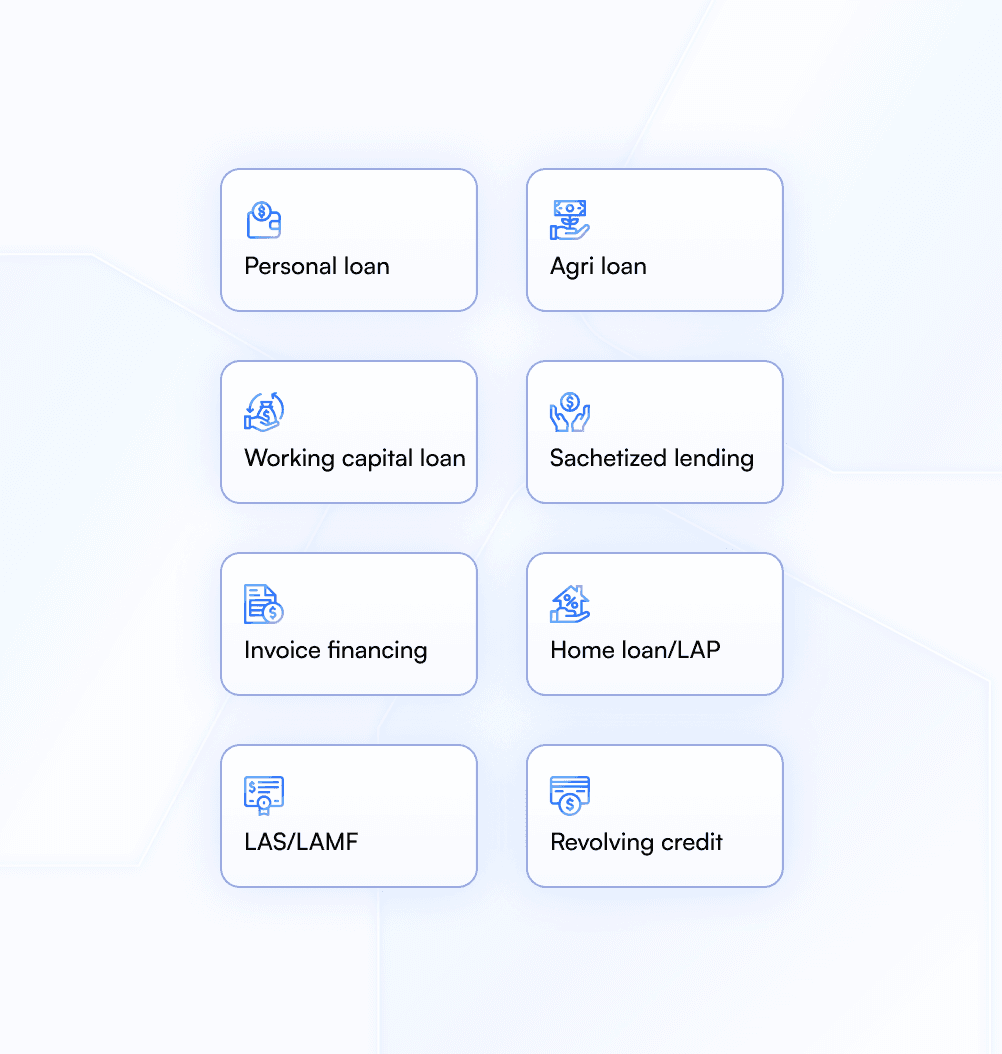

Loan products

Data sources

Partnership-based lending

Fraud Detection

Case Management

Tailored credit. Delivered at scale.

Launch successful products with a flavour of customization based on additional data sources and improved underwriting chops through ULI and ONDC platform data.

Unify lending. With our interface.

Loan products

Data sources

Partnership strategy

Expanding underwriting precision

Tailored credit. Delivered at scale.

Launch successful products with a flavour of customisation based on additional data sources and improved underwriting chops through ULI and ONDC platform data.

Unify lending. With our interface.

Loan products

Data sources

Partnership strategy

Expanding underwriting precision

Tailored credit. Delivered at scale.

Launch successful products with a flavour of customisation based on additional data sources and improved underwriting chops through ULI and ONDC platform data.

Supercharge lending

Streamline onboarding, accelerate lending, and enable data-driven decisioning

Streamline onboarding, accelerate lending, and enable data-driven decisioning

Supercharge lending

Streamline onboarding, accelerate lending, and enable data-driven decisioning

Supercharge lending

Risk Management

Identity Verification

Risk Management

Identity Verification

Risk Management

Identity Verification

FinBox raises $40M Series B

FinBox raises $40M Series B

Go live in 7 days, not 7 months

Increase in borrowers through open platforms

Better underwriting decisions with ULI Portfolio

Build for scale

Getting onboard ONDC is easy, scaling is tough. With ULI, accessing data is easy, harnessing it well is difficult. We help solve both these problems through our platform that combines product build, distribution and risk intelligence in one nifty package.

Build for scale

Getting onboard ONDC is easy, scaling is tough. With ULI, accessing data is easy, harnessing it well is difficult. We help solve both these problems through our platform that combines product build, distribution and risk intelligence in one nifty package.